If you’re a startup founder, early-stage investor, or key employee holding equity, the One Big Beautiful Bill (OBBB) just made your potential tax savings a lot more powerful.

Signed into law on July 4, 2025, the OBBB introduces major enhancements to Section 1202, the provision that governs Qualified Small Business Stock (QSBS). These modifications are designed to further incentivize investment in small businesses and startups by offering eligible shareholders more attractive tax benefits.

Before OBBB, Section 1202 allowed non-corporate taxpayers to exclude a substantial portion – often up to 100% – of capital gains from the sale of QSBS held more than five years. but the rules were rigid and limited in scope.

Now, with tiered holding periods, higher gain exclusion caps, and a broader definition of qualifying businesses, the OBBBA gives stakeholders more flexibility, faster access to tax benefits, and greater upside potential. Whether you’re planning an exit, raising capital, or evaluating your equity strategy, understanding these updates is essential to maximizing your after-tax returns.

Background: The Power of Section 1202

Enacted in 1993 as part of the Revenue Reconciliation Act, Section 1202 was designed to stimulate investment in small businesses by offering a significant tax incentive. The core benefit has always been the potential to exclude a substantial portion, often up to 100%, of federal capital gains from the sale of eligible stock. This makes QSBS a highly attractive tool for founders, early employees, and investors in qualified startup and growth companies.

Before the OBBB, for stock acquired after Sept. 27, 2010, and held for more than five years, the entire capital gain (up to certain limits) could be excluded from federal income tax. This exclusion also extended to the Alternative Minimum Tax (AMT) and the 3.8% Net Investment Income Tax (NIIT), offering a truly powerful tax shield. The primary rationale behind this generous tax treatment was to reward the risk-taking that’s inherent in investing in early-stage ventures, encouraging the flow of capital into job-creating small businesses that might otherwise struggle to attract funding.

How the OBBB Changes Section 1202:

The OBBB introduces three pivotal changes to Section 1202, making QSBS a more flexible and appealing investment vehicle:

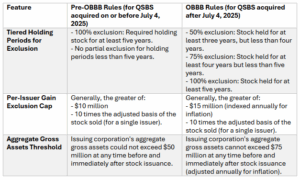

1. New QSBS Holding Periods and Exclusion Tiers: The OBBB replaces the previous “five-year cliff” for a 100% gain exclusion with a more flexible, tiered system. For QSBS acquired after the enactment date, taxpayers can now benefit from partial exclusions following shorter holding periods:

- 50% exclusion for stock held for at least three years but less than four years.

- 75% exclusion for stock held for at least four years but less than five years.

- 100% exclusion for stock held for at least five years.

This staggered approach provides crucial flexibility for founders and investors, allowing for significant tax savings even if an exit occurs before the five-year mark. It is particularly impactful for early-stage companies where liquidity events may happen sooner.

One note: Any non-excluded “Section 1202 gain” remains subject to a maximum 28% capital gains rate, higher than the standard long-term capital gains rates.

2. Increased Per-Issuer Gain Exclusion Cap: The OBBB raises the cap on the amount of gain that a taxpayer can exclude from taxation. Previously, this cap was generally the greater of $10 million or 10 times the adjusted basis of the stock sold. Under the OBBB, the $10 million component of the cap is increased to $15 million.

The benefit: This higher exclusion cap, which also will be indexed annually for inflation starting in 2026, allows investors to shield a greater portion of their gains from taxes, making investments in qualified small businesses even more appealing. Note: The alternative cap based on 10 times the stock’s basis remains unchanged.

3. Higher Aggregate Gross Assets Threshold: The OBBB also raises the asset threshold for a company to qualify as a small business for QSBS purposes. Previously, the issuing corporation’s aggregate gross assets (cash plus adjusted tax bases of other property) could not exceed $50 million at any time before and immediately after the stock issuance. The OBBBA increases this limit to $75 million, also to be adjusted for inflation annually beginning in 2026.

The benefit: This expansion broadens the range of companies that can issue QSBS-eligible stock, allowing slightly larger startups and those in capital-intensive industries like technology and manufacturing to qualify for these beneficial tax provisions.

Comparison of Pre-OBBB and OBBB Rules for QSBS

Impact and Implications of OBBB’s QSBS Reforms:

The QSBS changes under the OBBB are expected to have an impact on the startup and small business ecosystem, as well as on investors and private equity firms:

- Enhanced Investment Appeal: The reduced holding periods and increased exclusion caps make investments in small businesses significantly more attractive, promising higher after-tax returns for investors.

- Broader Investment Opportunities: The higher asset threshold expands the universe of companies that can qualify for QSBS benefits, giving private equity firms and individual investors a wider array of potential investment targets.

- Increased Capital Flow: These favorable tax conditions are likely to stimulate greater capital flow into the small business sector, fostering innovation, growth, and job creation.

- Strategic Planning Considerations: Investors and business owners with existing QSBS or plans for future investments should proactively review their holdings and strategies. For shares acquired before the OBBB’s enactment date (July 4, 2025), the old rules still apply, including the five-year holding period and $10 million exclusion cap.

Your Takeaway

The OBBB’s amendments to Section 1202 represent a clear commitment to encouraging domestic investment and supporting the growth of America’s small businesses. While the intricacies of the new rules require careful navigation, the enhanced benefits undoubtedly position QSBS as an even more powerful tool for tax-efficient wealth creation in the startup and entrepreneurial landscape.

Anthony Licavoli is the director of tax consulting and part of Rehmann’s Transaction Advisory Service group, which boasts specialists with experience analyzing and documenting Section 1202 stock eligibility.

Erik Schumacher is a principal in Rehmann’s Advisory and Tax Services arm. Boasting a background providing tax consulting and compliance services to large companies with international and private equity ownership, Schumacher today serves a broad range of clients across multiple industries, including the cannabis, energy, manufacturing, and private equity sectors.

Please reach out to your Rehmann advisor or — for guidance on how these incentives might impact you or your company — contact [email protected] or [email protected].