If your business, municipality, or organization has any clean energy investments underway or on its agenda, the One Big Beautiful Bill (OBBB) demands your immediate attention.

This legislation reshapes the landscape of federal clean energy incentives — accelerating timelines, tightening eligibility, and redefining strategic priorities. Whether you’re planning to invest in solar arrays, expand EV infrastructure, or modernize public facilities with energy-efficient upgrades, the window to act is narrowing.

The OBBB compresses the availability of key tax credits for wind, solar, and clean vehicles, while introducing new restrictions tied to foreign supply chains and domestic content. At the same time, it preserves support for technologies like nuclear, geothermal, and clean fuels — signaling a shift in federal focus.

Understanding these changes is critical not only for securing funding and incentives, but also for aligning your projects with evolving compliance and procurement standards.

This article breaks down the most consequential updates, helping you assess risks, seize short-term opportunities, and prepare for a more selective and security-conscious clean energy future.

Accelerated Phase-Out for Wind and Solar

Perhaps the most immediate and significant impact of the OBBB lies in the accelerated phase-out of the cornerstone clean energy incentives: the Sec. 48E Clean Electricity Investment Credit and the Sec. 45Y Clean Electricity Production Credit for new wind and solar projects.

Under the OBBB, the window to secure the full value of these credits has been significantly compressed. To qualify, projects must be placed in service by Dec. 31, 2027. An exception exists for any project that begins construction before July 4, 2026. Energy storage technology placed in service at wind and solar facilities is not subject to this phase-out.

Expected Impact: This drastically shortened timeline is expected to create a surge of development activity in the immediate term as developers rush to meet these deadlines. However, it also casts a shadow of uncertainty over projects with longer development cycles, potentially leading to a slowdown in new wind and solar deployments beyond 2027.

What to Watch For: Updated guidance from Treasury regarding the definition of “beginning of construction” is anticipated in late August.

Foreign Entities of Concern (FEOC) Rules

A significant and potentially far-reaching aspect of the OBBB’s energy credit modifications is

the introduction of stringent rules regarding “foreign entities of concern” (FEOC).

The OBBB incorporates the definition of a FEOC as outlined in existing U.S. law and policy. This definition generally includes entities that are owned by, controlled by, or subject to the jurisdiction of a government of a foreign country that is a covered nation, such as China, Russia, Iran, and North Korea.

Under the OBBB, projects utilizing equipment or components manufactured or assembled by a FEOC may be ineligible for the clean electricity tax credits for construction dates beginning after Dec. 31, 2025. This restriction extends beyond direct ownership and includes instances where a significant portion of the supply chain involves FEOCs.

What to Watch For: This change necessitates enhanced due diligence from developers, who will need to trace the origin of all significant components and scrutinize ownership structures to avoid disqualification.

Expected Impact: These provisions represent a clear move to bolster domestic energy security and ensure that U.S. clean energy incentives primarily benefit American and allied enterprises.

Vehicle and Alternative Fuel Infrastructure Changes

The OBBB also makes a number of key changes to credits for clean vehicles and related infrastructure. The Alternative Fuel Vehicle Refueling Property Credit (Section 30C) is terminated for property that is placed in service after June 30, 2026, significantly shortening the credit’s lifespan from its previous 2032 expiration.

Similarly, the Commercial Clean Vehicle Credit (Section 45W) for businesses is terminated for vehicles acquired after Sept. 30, 2025.

Expected Impact: These changes create a narrow window for businesses to make capital investments in clean vehicle fleets and charging infrastructure, potentially leading to a short-term rush to purchase assets that meet the deadlines.

Preservation and Extension for Other Clean Energy Technologies

While wind and solar face an accelerated phase-out, the OBBB demonstrates continued support for other crucial clean energy technologies. The Zero-Emission Nuclear Power Production Credit remains a key part of the energy landscape. Support for geothermal energy projects also continues under existing provisions, recognizing its potential for reliable renewable power.

The clean fuel production credit, which incentivizes the production of clean transportation fuels, has been extended under the OBBB. However, the extension comes with new restrictions on the sourcing of feedstocks, likely aimed at promoting the use of sustainable and domestically produced inputs.

Elimination of Key Energy Efficiency Incentives

In a notable shift, the OBBB eliminates two previously important tax incentives for energy efficiency in the built environment. The deduction for designing and constructing energy-efficient commercial buildings is terminated for projects where construction begins after June 30, 2026.

Similarly, the tax credit for the construction of new energy-efficient homes is removed for homes acquired after June 30, 2026.

Expected Impact: The elimination of these incentives could potentially slow down the adoption of advanced energy efficiency measures in both commercial and residential construction.

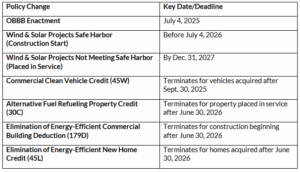

Energy Credit and Incentive Changes at a Glance:

Overall Impact and Future Outlook

The OBBB represents a significant recalibration of federal clean energy tax policy. The accelerated timelines for wind and solar credits will likely lead to a near-term boom in development, followed by a potentially more challenging landscape. The increased focus on domestic content and restrictions on foreign entities will necessitate adjustments in supply chains and project partnerships. The continued support for other clean fuels, alongside the removal of key energy efficiency incentives, suggests a strategic prioritization of certain technologies and a renewed emphasis on energy security.

How Will the OBBB Impact Your Operations?

The One Big Beautiful Bill is reshaping the clean energy landscape — and the clock is ticking. If you’re a business owner, developer, or public sector leader, now is the time to assess your projects, supply chains, and investment plans. Don’t miss critical deadlines or risk losing access to valuable incentives.

Rehmann has a dedicated team focused on investigating, analyzing, and calculating energy tax credits and incentives while ensuring compliance. Please contact us to stay ahead of these sweeping changes. The future of clean energy is still bright — but only for those ready to move quickly and strategically.