The One Big Beautiful Bill (OBBB) Act is reshaping how private colleges and universities manage their finances. Whether your institution is directly affected by the new graduated endowment tax or not, the law introduces sweeping changes that demand attention.

If you’re uncertain about what this means for your institution, you’re not alone. Here’s a breakdown of what you need to know about the endowment excise tax and new reporting requirements — and what you should do now to prepare.

What’s Changing: The Graduated Endowment Tax

The centerpiece of the OBBB is the introduction of a new, tiered excise tax on net investment income for certain private colleges and universities. The tax rate is determined by the value of an institution’s endowment per full-time student.

An institution is subject to the tax if it meets these criteria:

- It is a private, tax-exempt college or university.

- It has at least 3,000 tuition-paying students — a significant increase from the previous threshold of 500 students — during the preceding taxable year.

- More than 50 percent of its tuition paying students must be located in the United States.

- The fair market value of its endowment assets at the end of the preceding taxable year is greater than $500,000 per student.

It’s important to note that the OBBB has removed previous exemptions for qualified religious institutions and foreign students, broadening the potential scope of the tax.

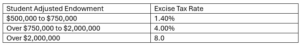

The OBBB’s Graduated Tax Rates for University Endowments

Based on the amount of endowment per student, the OBBBA’s graduated excise tax falls into three tiers. It’s structured so that institutions with larger per-student endowments contribute more in taxes — a change aimed at promoting equity and accountability in higher education funding.

The new tax rates are based on the institution’s “net investment income” (see below for details) and the per-student endowment value:

Expanded Definition of Net Investment Income

A critical change under the OBBB is the broadened definition of “net investment income,” which now includes more revenue streams than ever before. This expansion may increase tax exposure for institutions with diverse investment portfolios or significant intellectual property revenue.

Taxable income now includes:

- Dividends, interest, rents, and royalties

- Net capital gains from the sale of assets

- Income from securities lending

- Federally subsidized royalty income: This newly included category refers to income from intellectual property, such as patents, that was developed with the support of federal funding.

- Student loan interest: Interest income generated from institutional student loan programs is also now considered taxable.

Assets and income from related entities must also be evaluated for inclusion, which could have significant implications for institutions with complex organizational structures.

However, certain revenue sources remain excluded from the definition of net investment income, most notably tuition, student fees, and unrealized capital gains.

New Expanded Reporting Requirements

The OBBB introduces stringent new reporting obligations that require meticulous data collection and documentation.

1. Student Counts

Institutions must now report two distinct student metrics:

- The number of tuition paying students.

- The daily average of full–time students, with part time students taken into account on a full-time equivalent basis.

New Anti-Avoidance and Fund Structuring Rules

The OBBB gives the IRS greater authority to scrutinize how endowment funds are structured to prevent tax avoidance. Institutions should expect increased monitoring of transactions designed to reduce net investment income exposure.

These anti-avoidance provisions specifically target:

- Transfers between funds: Shifting assets to different funds to change their tax character.

- Reclassification of assets: Altering the classification of assets to avoid taxation.

- Use of related entities: Using separate but related organizations to hold assets and shield income.

Tip: Proactive, professional evaluation of your fund structures will be essential to ensure you can defend your positions and remain compliant.

Charting Your Course: Next Steps

Navigating these changes requires a dual approach: immediate action to ensure compliance in the short term and strategic planning for long-term financial health.

Short-Term Action Steps for 2025–2026

To prepare for the immediate impact of the OBBB, your institution should focus on these critical tasks:

- Verify Student Counts and Endowment Valuation: Begin meticulously tracking and documenting student enrollment and endowment asset values according to the new definitions.

- Identify Taxable Income Sources: Conduct a thorough review of all income streams to identify what now falls under the expanded definition of net investment income.

- Update Documentation and Reporting Systems: Ensure your internal systems are capable of capturing the necessary data for the new requirements once the IRS provides updated guidance.

- Brief Leadership and Trustees: Educate your leadership team and board of trustees on the compliance implications and potential financial impact of the OBBB.

Long-Term Strategic Planning

Looking beyond immediate compliance, it’s time to think strategically about your institution’s financial future within this new regulatory landscape. Rehmann’s higher education business advisors can help your institution:

- Evaluate Fund Structures: Assess your current endowment and related entity structures to identify and mitigate potential tax exposure.

- Consider Portfolio Adjustments: Explore adjustments to your investment portfolio that could help manage taxable income effectively.

- Proactively Respond: Ensure you understand and align with evolving standards and best practices.

- Remain Informed IRS and Treasury Guidance: We continue to monitor forthcoming guidance from the IRS and the Department of the Treasury to ensure you adapt your strategies accordingly.

- Communicate with Stakeholders: We can guide you in communicating with donors, alumni, and other key stakeholders about how your institution is navigating these changes to maintain transparency and trust.

Secure Your Institution’s Future

The endowment tax overhaul introduced by the OBBB presents significant challenges, but it also provides an opportunity to strengthen your institution’s financial governance and strategic planning. By taking decisive, informed action now, you can navigate this new regulatory environment with confidence and empower your institution for sustained success.

If you have questions about how these changes will affect your institution, our higher education business advisors can determine the impact and help you navigate the path forward. Learn more about our services or contact us here.