Starting in tax year 2026, the One Big Beautiful Bill’s changes to federal income tax rules for charitable giving go into effect. Both corporations and individuals intending to make charitable contributions in the coming years will be affected.

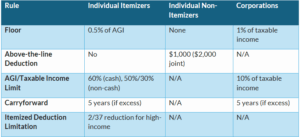

Among the changes: Corporations will have updated limits to work with. Individuals who itemize their deductions will see new floors on their adjusted gross income (AGI). And those who don’t itemize will see the return of an above-the-line deduction, making it possible to see a tax benefit for charitable gifts without having to exceed the standard deduction.

No matter which category you fall into, revisiting your plans for charitable giving will be a critical part of your tax strategy in 2025, 2026, and beyond. Below, we’ll break down the new rules, offer examples, and highlight practical strategies to help you maximize your donations while staying tax-smart.

What is the new above-the-line deduction for non-itemizers?

For the first time since the temporary COVID-era provisions, non-itemizing taxpayers may claim an above-the-line deduction for cash contributions to public charities (excluding donor-advised funds and supporting organizations). This deduction is capped at $1,000 for single filers and $2,000 for married couples filing jointly, per year.

How does the new AGI Floor affect itemizers?

Itemizing taxpayers may only deduct the portion of their total charitable contributions that exceeds 0.5% of AGI. This new floor applies to all types of charitable contributions and is calculated before applying the traditional AGI percentage limits.

AGI Percentage Limits for Itemizers

- Cash contributions to public charities: 60% of AGI limit is now permanent.

- Non-cash contributions to public charities: 50% of AGI limit.

- Contributions to private foundations or for appreciated property: 30% of AGI limit.

- Contributions of appreciated property to certain private foundations and other non-50% organizations: 20% of AGI limit.

How does the OBBB limit deductions for high-income taxpayers?

For taxpayers in the 37% bracket, the value of itemized deductions (including charitable contributions) under the OBBB is limited to 35% of the deduction amount. Itemized deductions are reduced by 2/37 of the lesser of (a) total itemized deductions or (b) the amount by which taxable income (plus itemized deductions) exceeds the 37% bracket threshold.

What are the OBBB’s charitable contribution rules for corporations?

Corporations now face a 1% of taxable income floor for charitable deductions. Only contributions exceeding 1% of taxable income are deductible, up to the 10% cap. Amounts disallowed due to the floor can be carried forward for up to five years, but only from years in which the 10% cap is exceeded.

Your Takeaway: Key Planning Strategies for Charitable Contributions Under OBBB

- Accelerate Gifts: Consider making larger charitable gifts in 2025 to avoid the new floors and limitations that begin in 2026.

- Bunch Contributions: Itemizers may benefit from “bunching” several years’ worth of donations into a single year. This can help to exceed the 0.5% floor and maximize deductions. You can do this with outright gifts, or with gifts to a donor advised fund (DAF). Gifting through a DAF allows you to make a large, immediate deduction now while distributing to charities over time.

- Utilize Qualified Charitable Distributions (QCDs): Taxpayers age 70 ½+ can make tax-free IRA distributions to qualified charitable organizations, which count toward required minimum distributions and reduce taxable income. These individuals can donate up to $108,000 per person in 2025 and $111,000 in 2026.

- Cash Gifts for Non-Itemizers: Starting in 2026, if you take the standard deduction, take advantage of the new above-the-line deduction for cash gifts to public charities up to your filing status limit ($1,000 single/$2,000 joint).

Understanding the nuances of charitable contribution deductions isn’t only crucial for effective financial planning; it can help maximize the impact of your generosity. By staying informed about the latest IRS rules and limitations, you can make strategic decisions that align with both your philanthropic goals and tax planning needs.

If you have questions or need assistance navigating your charitable giving strategy, the tax professionals at Rehmann can help ensure your contributions not only support the causes you care about but also work to your advantage during tax season. Click here to learn more or contact us.

Frequently Asked Questions

Q: Do the OBBB changes apply to the 2025 tax year?

A: No, these new rules for charitable contributions, including the AGI floors and non-itemizer deduction, are effective for tax years beginning after December 31, 2025.

Q: Can I use the above-the-line deduction for a gift to my family’s private foundation?

A: No, the above-the-line deduction for non-itemizers is only for cash contributions to public charities. It explicitly excludes contributions to donor-advised funds, supporting organizations, and private foundations.

Q: What happens if my donation is below the 0.5% AGI floor?

A: If you are an itemizer and your total annual charitable contributions do not exceed 0.5% of your AGI, you will not be able to deduct any of those contributions for that tax year.