For plan years beginning on or after Jan. 1, 2026, significant changes to qualified retirement plans take effect. These updates, driven by the SECURE 2.0 Act, introduce new contribution limits and mandatory Roth requirements for high earners — those earning over $150,000 in FICA wages.

Plan sponsors and administrators must prepare now to address the compliance, payroll, and record-keeping adjustments to meet these new standards.

This guide outlines the critical changes to catch-up contributions and provides actionable steps for maintaining plan compliance.

What Are the 2026 Catch-up Contribution Rules?

The 2026 updates introduce distinct rules for standard elective deferrals and catch-up contributions, with specific provisions for employees ages 60–63. These changes require plan sponsors to differentiate between standard catch-up limits and the new “Super Catch-up Tier.”

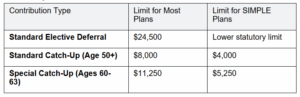

2026 Contribution Limits Overview

The following limits apply to most 401(k) and 403(b) plans for plan years beginning on or after Jan. 1, 2026:

- Traditional Deferrals: The annual limit for standard pre-tax elective deferrals is set at $24,500 for most plans.

- Standard Catch-up: Employees age 50 or older by the end of the calendar year may contribute an additional $8,000 to most plans ($4,000 for SIMPLE plans).

- Special Catch-up (Ages 60-63): Participants who attain age 60, 61, 62, or 63 during the year are eligible for a higher catch-up limit of $11,250 for most plans ($5,250 for SIMPLE plans).

This tiered structure allows older employees to maximize their savings as they approach retirement, but it also adds a layer of administrative complexity for payroll processing.

Mandatory Roth Catch-up for High Earners

A critical compliance change in 2026 is the mandatory “catch-up” rule. This provision mandates that high-income employees can no longer make pre-tax catch-up contributions; they must be designated as Roth (after-tax) contributions.

Who Is Subject to the Roth Mandate?

The Roth mandate applies to employees who:

- Are age 50 or older.

- Earned more than $150,000 in FICA wages from their employer in the preceding calendar year. (Determinations made for the 2026 plan year will be based on FICA wages earned in 2025.)

Plan sponsors, please note: If a plan allows catch-up contributions but does not offer a Roth option, it must be amended to allow one. Without this amendment, high earners age 50+ will be unable to make any catch-up contributions.

Compliance: What Plan Administrators Must Do

The transition to mandatory Roth catch-ups requires robust administrative updates. Plan sponsors should focus on the following key areas to avoid costly compliance errors:

- Payroll System Updates: Your payroll system must be capable of tracking prior-year FICA wages. It needs to identify employees subject to the mandate and automatically route their catch-up contributions to Roth accounts, rather than pre-tax buckets.

- Universal Availability: If the Roth catch-up feature is required for high earners, it must be made available to all eligible employees, regardless of income level.

- Correction Protocols: Despite best efforts, errors in contribution classification may occur. They must be corrected promptly. Here’s how:

- Pre-W-2: Errors caught before W-2 filing can generally be reclassified as Roth contributions.

- Post-W-2: Errors identified later typically require an in-plan Roth rollover.

- De Minimis Exception: No correction is required for errors involving amounts of $250 or less.

Strategic Steps for Plan Sponsors

To ensure seamless implementation of the Roth mandate by the Jan 1, 2026, effective date, plan sponsors should take the following steps:

- Review Plan Documents: Consult with your advisor to determine if a plan amendment is necessary to add Roth contribution capabilities.

- Audit Payroll Capabilities: Verify that your payroll provider can automatically flag high earners based on the $150,000 threshold and enforce the Roth requirement.

- Execute Amendments: Complete all necessary plan amendments by the deadline (generally Dec. 31, 2026, for most plans).

- Communicate Effectively: Launch employee education initiatives to explain the new rules, specifically targeting those age 50+ and high-income participants affected by the changes.

Summary of 2026 Limits

Note: High earners ($150k+ in prior-year FICA wages) must designate all catch-up amounts as Roth contributions.

The Takeaway

The 2026 changes aim to enhance retirement savings for older employees while altering the tax treatment for high earners. However, they also introduce complexity into plan administration. By proactively updating systems and communicating with participants, plan sponsors can navigate these changes effectively and help employees maximize their retirement readiness.

Frequently Asked Questions

Q: Who is affected by the mandatory Roth catch-up rule in 2026?

A: Employees aged 50 or older who earned more than $150,000 in FICA wages from their employer in the previous year are affected. They must make all catch-up contributions on a Roth (after-tax) basis.

Q: What is the “Super Catch-Up” limit for 2026?

A: For participants aged 60, 61, 62, or 63, the catch-up contribution limit increases to $11,250 for most plans and $5,250 for SIMPLE plans.

Q: Do I need to amend my plan if I don’t already have a Roth option?

A: Yes, if your plan allows catch-up contributions, you must amend it to allow Roth contributions. If you do not add a Roth feature, high earners subject to the mandate will be prohibited from making catch-up contributions entirely.